Looking to Defer Capital Gains Tax?

Discover our 1031‑eligible investment opportunities. Reinvest proceeds, defer taxes, and grow your real‑estate portfolio.

1031 Exchange vs 1031 DST Exchange

1031 Exchange — Direct Ownership

For investors who want to stay hands-on.

- You purchase and own an entire replacement property.

- You make all decisions leasing, maintenance, operations, and improvements.

- You must qualify for and secure your own financing.

- Typically requires larger capital to acquire a full asset.

- Harder to diversify since funds usually go into one property.

- Best for investors who want full control and don’t mind active management.

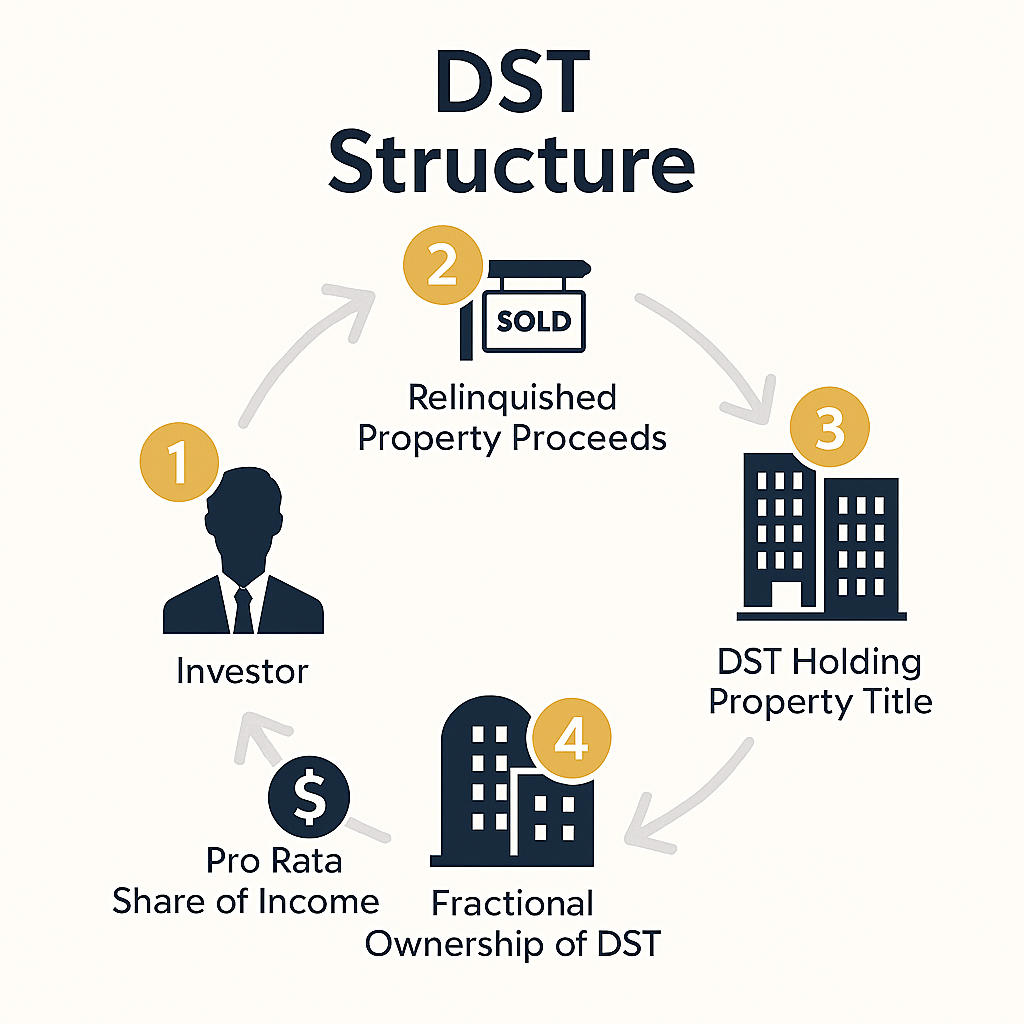

1031 DST Exchange — Fractional, Passive Ownership

For investors who want real estate income without the workload.

- You invest in a fractional interest of a large, professionally managed property.

- 100% passive — the DST sponsor handles all operations, leasing, repairs, and asset management.

- No personal loan qualification — financing is already arranged at the trust level.

- Lower entry minimums allow broader diversification across multiple assets.

- Helps meet 45/180-day deadlines more easily due to ready-to-close structure.

- Ideal for investors seeking hands-off income, retirement-friendly options, or simplified exchanges.

Why Use a 1031 Exchange with Us?

By using a 1031 Exchange, you avoid immediate capital-gains tax when you sell an investment property giving you more capital to reinvest. We offer a curated selection of 1031-eligible properties and handle all the logistics, from Qualified Intermediary coordination to closing the deal so you can keep building your portfolio.

What is a 1031 Exchange — Quick Overview

A 1031 Exchange is a powerful tax-deferral strategy that allows real estate investors to sell an investment or business-use property and reinvest the proceeds into another like-kind property without paying capital gains tax at the time of sale. By deferring taxes, investors can keep more equity working for them, helping build wealth more efficiently.

Under Section 1031 of the IRS tax code, to qualify for the deferral:

- The property sold and the property acquired must both be held for business or investment purposes

- A qualified intermediary must hold the sale proceeds during the exchange process

- The replacement property must be identified within 45 days

- The transaction must be completed within 180 days

How it Works (4 Steps)

Sell Investment Property → Reinvest → Defer Capital Gains Tax

How it Works (4 Steps):

- Sell Your Property

Must be an investment or business-use property - Proceeds Held by a Qualified Intermediary

You can’t touch the funds directly - Identify New Property Within 45 Days

Choose like-kind real estate options - Close on Replacement Within 180 Days

Complete the purchase to defer taxes